Adulting, Made Easier – Stories & Straight Talk

Quick reads, helpful tips, and honest breakdowns of what you need to know.

Featured Posts

10 Essential Steps to Ensure a Comfortable Retirement: Part 2

In the first part of our series on practical steps for ensuring a comfortable retirement, we covered estate planning, passing on a legacy, and preparing for long-term care. This week, we continue with five more steps, including adapting your home for comfort and safety and leveraging technology for independence. Implementing these steps will provide you with greater peace of mind in your later years. Read more.

10 Essential Steps to Ensure a Comfortable Retirement: Part 1

Retirement marks the beginning of an exciting new chapter in life, far beyond just the end of your working years. Thoughtful preparation and strategic planning are essential. During this Older Americans Awareness Month, discover five practical steps you can take now to ensure a comfortable and fulfilling retirement. Read more.

Obtaining A Power Of Attorney For Elderly Parents

Making important decisions for aging parents can be a challenging task, but power of attorney (POA) can provide peace of mind and clarity in times of need. POA enables individuals to make crucial decisions on behalf of their parents, such as managing their finances or making medical decisions when they are unable to do so themselves due to age or illness.

While it may be difficult to approach this topic with your parents, having these discussions early on can help ensure that you follow their wishes if their health changes over time. Starting the conversation with empathy and understanding can make all the difference.

In this article, we'll explore how to obtain power of attorney for elderly parents and provide helpful tips on how to approach these discussions with warmth and care. After all, our ultimate goal is to ensure that your aging parents receive the best possible care and support.

4 Year-End Tax-Saving Strategies For 2022

Although the end of the year can be a hectic time, it’s also the deadline for your family to implement a number of key tax-savings strategies. By taking action now, you can significantly reduce your tax bill due in April, but with just a few weeks left in 2022, you better act fast.

While there are dozens of potential tax breaks you may qualify for, here are 4 of the leading moves you can make to save big on your 2022 tax return. However, there may be other opportunities for saving, so meet with us, your Personal Family Lawyer® to make certain you haven’t missed a single one.

Key Milestones For Planning Your Retirement

The road to retirement is a long one, and as with any journey, it helps to have a few key milestones along the way to help gauge your progress. While your individual retirement plan and goals will be unique to your income, family situation, and desired lifestyle, most Americans share a number of common retirement milestones.

These milestones are based on your age, along with important dates and deadlines related to Social Security benefits, Medicare, and tax-advantaged retirement plans. Although you should work with us, your Personal Family Lawyer®, and financial advisor to develop a comprehensive retirement strategy as part of your overall Life & Legacy Plan, we include several of the key milestones here.

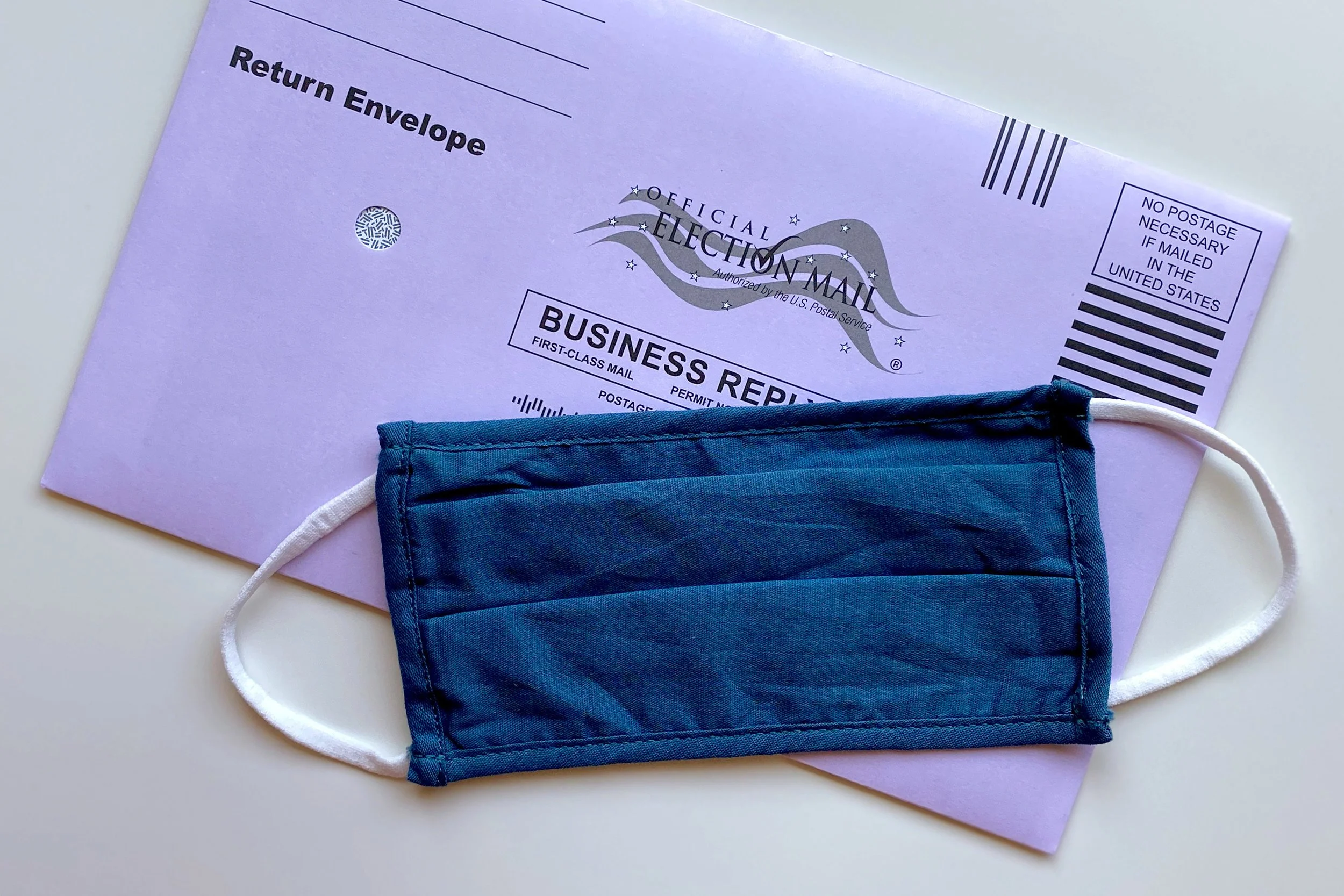

Start Planning Now to Prepare Your Estate for a Possible Democratic Sweep—Part 2

No matter who you vote for on November 3rd, you may want to start considering the potential legal, financial, and tax impacts a change of leadership might have on your family’s planning. As you’ll learn here, there are a number of reasons why you may want to start strategizing now if you could be impacted, because if you wait until after the election, it could be too late.

While we don’t yet know the outcome of the election, Biden could win and the Democrats could take a majority in both houses of Congress. If that does happen, a Democratic sweep would have far-reaching consequences on a number of policy fronts. But in terms of financial, tax, and estate planning, it’s almost certain that we’ll see radical changes to the tax landscape that could seriously impact your planning priorities. And while it’s unlikely that a tax bill would be enacted right away, there’s always the possibility such legislation could be applied retroactively to Jan. 1, 2021.

Lost An Old 401(k)? Here Are 6 Tips For Finding It

The days of working for a single employer for decades until you retire are over. Today, you are much more likely to change jobs multiple times during your career. According to the Bureau of Labor Statistics, today’s workers have held an average of 12 jobs by the time they reach their 50s.

Since people change jobs so frequently, it is easy to see you might lose track of an old 401(k) or retirement account, especially if you only worked in a position for a short time. In fact, forgetting plans is quite common: it’s estimated that roughly 900,000 workers lose track of their 401(k) plans each year. And when you forget to cash out your 401(k) upon leaving a job, your former employer might no longer have control of your account.

3 Deadly Sins of Retirement Planning

Retirement planning is one of life’s most important financial goals. Indeed, funding retirement is one of the primary reasons many people put money aside in the first place. Yet many of us put more effort into planning for our vacations than we do to prepare for a time when we may no longer earn an income.

Whether you’ve put off planning for retirement altogether or failed to create a truly comprehensive plan, you’re putting yourself at risk for a future of poverty, penny pinching, and dependence. The stakes could hardly be higher.

Should You (or Your Parents) Be in the Stock Market Now?

If you or your parents have a retirement account, (or any investment accounts for that matter) now is the time to get connected to how those accounts are invested. While you may have outsourced all of this to a broker in the past, you can no longer afford to allow your investments to be made without your clear understanding of exactly what you are investing in, how and whether your investments align with your plans for the future.

The SECURE Act’s Impact On Estate and Retirement Planning—Part 2

In the first part of this series, we discussed the potential ramifications the SECURE ACT has for your estate and retirement planning.

Here, we’ll cover the SECURE Act’s impact on your financial planning for retirement, offering strategies for maximizing your retirement account’s potential for growth, while minimizing tax liabilities and other risks that could arise in light of the legislation’s legal changes.

The SECURE Act’s Impact On Estate and Retirement Planning—Part 1

On January 1, 2020, the Setting Every Community Up for Retirement Enhancement Act (SECURE Act) went into effect, and it represents the most significant retirement-planning legislation in decades.Indeed, the changes ushered in by the SECURE Act have dramatic implications for both your retirement and estate planning strategies—and not all of them are positive. While the law includes a number of taxpayer-friendly measures to boost your ability to save for retirement, it also contains provisions that could have disastrous effects on planning strategies families have used for years to protect and pass on assets contained in retirement accounts.

Given this, if you hold assets in a retirement account you need to review your financial plan and estate plan as soon as possible. To help you with this process, here we’ll cover three of the SECURE Act’s biggest changes and how they stand to affect your retirement account both during your lifetime and after your death. Next week, we’ll look more deeply into a couple of additional strategies you may want to consider.