Adulting, Made Easier – Stories & Straight Talk

Quick reads, helpful tips, and honest breakdowns of what you need to know.

Featured Posts

Your Belongings After You’re Gone: What Your Family Needs to Know

You’ve spent a lifetime building a home full of memories, meaning, and things you care about. Without the right plan in place, those same items can quickly become overwhelming for the people you love. Read more…

Service, Sacrifice & Strategy: Estate Planning That Honors Military Families

Veterans Day reminds us not only to honor those who’ve served but also to recognize the unique needs of military families when it comes to estate planning. From survivor benefits to military pensions and deployment considerations — these plans require a little extra strategy and a lot of heart.

Learn how to protect your loved ones and the legacy you’ve worked so hard to build. Read more…

Build It. Keep It. Pass It On: Smart Planning for Generational Wealth

Building generational wealth isn’t just about investing smarter — it’s about planning smarter. It takes rethinking how you pass on what you’ve built, how you teach your kids about money, and how you protect your legacy for the long run. Read more…

Building a Life Together? Make Sure the Law Doesn’t Tear It Apart

Being unmarried doesn’t mean being unprotected but without the right estate plan, that’s exactly the risk you run. The law won’t automatically give your partner the rights you probably assume they’d have. Want to make sure they’re cared for and not cut out? That takes planning. Read more…

Estate Planning Awareness Week: Protecting Your Family Is the Ultimate Love Language

It’s Estate Planning Awareness Week: Let’s be real—estate planning isn’t just about papers in a drawer. It’s about love, clarity, and making life easier for the people you care about most. Done right, it’s the greatest gift you can give your family. Read more and see why planning now is the ultimate act of adulting (and love). Read more…

Estate Planning Isn’t a Transaction (It’s a Transformation)

Too many estate plans fail because they start with a cookie-cutter, “sign here” meeting. That’s not planning, that’s paperwork. An Estate Planning Session flips the script. It’s not about documents in a drawer; it’s about creating a plan packed with meaning, clarity, and real value for you and everyone you love. Read more…

No Plan, Big Problems: The Real Costs of Aging Unprepared

More and more adults are aging alone and even with family nearby, the reality is that aging brings challenges no one sees coming. With thoughtful estate planning, you can make sure you’re cared for with dignity and that your wishes are honored. A solid Estate Plan takes the guesswork off your family’s shoulders and gives you peace of mind knowing nothing is left to chance. Read more…

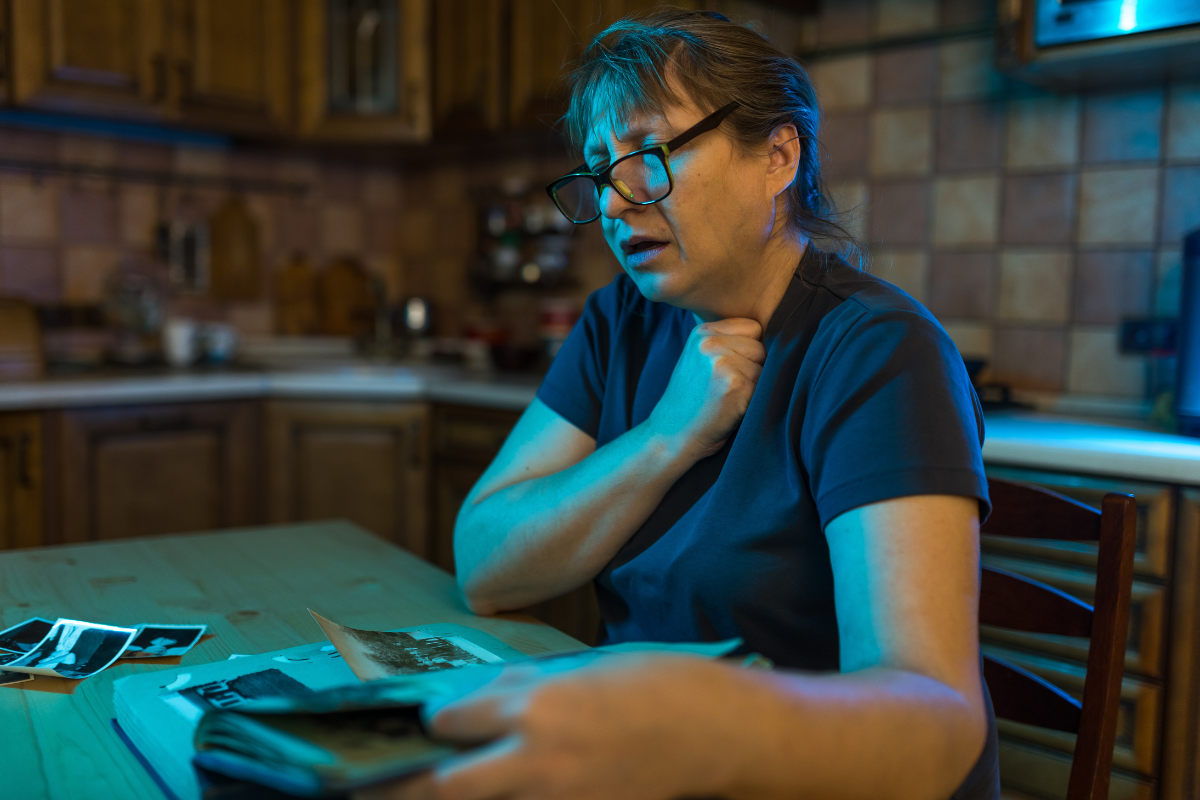

The Gift Hidden in Grief: How Planning Ahead Eases the Hardest Days

Losing someone you love flips your world upside down in ways you can’t always prepare for. But here’s the truth, you can make the road ahead lighter for the people you love. A little planning now saves them a whole lot of chaos later. Read more…

If You Can Meal Plan, You Can Estate Plan

How you plan meals says a lot about you, do you wing it, or do you actually map it out so no one’s hangry by Wednesday? The same is true for estate planning. If you’re intentional with time and money in the kitchen, you should be just as intentional when it comes to protecting your family’s future. Read more.

When Margaritaville Meets Mayhem: What Jimmy Buffett’s Estate Mess Can Teach the Rest of Us

Jimmy Buffett may have made a fortune singing about island vibes and chill days in Margaritaville, but his $275 million estate? Yeah, that’s not exactly on island time. Turns out, when there’s no plan—or the wrong one—the paradise gets messy real fast.

Read more on why even the king of chill needed a solid estate plan (and what you can learn from it)...

Honor the Legacy You've Built—It's Worth Protecting

With Veterans Day approaching, we take a moment to honor the courageous men and women who served our country with steadfast dedication. Your service showed a deep commitment to safeguarding our nation’s future—now, let’s focus on securing your family’s future. Read more.

Debunking Common Misconceptions About Estate Planning

October 21-27 marks National Estate Planning Awareness Week—a perfect time to bring clarity to this often overlooked and misunderstood subject. Let’s dive in and explore why estate planning is essential for securing your future and protecting what matters most. Read more.

How Is Estate Planning Like Crafting the Perfect Lasagna?

Many people assume that 'estate planning' just means creating a will or trust, but that's a common misunderstanding. Estate planning isn't just about paperwork—it's more like crafting the perfect lasagna recipe, with layers of thoughtful preparation. Learn more.

Exploring Celebrity Estate Plans: Part 1 of 4 - Michael Jackson

For some reason, we can’t resist a juicy celebrity story. Over the next few weeks, we’ll delve into the lives of four celebrities and examine how they planned for the inevitable—or failed to! This week, we're shining the spotlight on the King of Pop, Michael Jackson. Read more.

What Becomes of Your Social Media Accounts After You Pass Away?

Ever curious about the fate of your social media accounts after you're gone? Each platform follows its own set of rules, making it crucial to understand these policies to manage your digital presence responsibly. Continue reading to learn more.

Your Essential New Year's Resolution: Establishing a Protection Plan for Your Children

As we embrace the New Year, brimming with optimism and goals for a better future, prioritizing one resolution is key – establishing a Kids Protection Plan™. Continue reading to learn more…

Estate Planning Essentials for Caregivers of Individuals with Dementia - Part 1

In this article, we delve into the significance of estate planning for those diagnosed with dementia. It's a vital step in safeguarding the preferences and legal rights of your loved one. Continue reading to learn more.

Have Unused 529 College Savings? Roll Them Into a Roth in 2024

In 2024, the SECURE 2.0 Act brings significant changes to the world of retirement savings and college savings accounts that could substantially impact your family's financial future. Read more…

How to Talk Money With Your Family Over The Holidays

The holidays are a perfect time to bring up conversations around inheritance, end of life, and stepping into another level of connection and intimacy, if you do it right. Otherwise, it could end in a big unresolved mess. Asking your relatives how they want their money and belongings handled when they die or if they become incapacitated might not go over well while opening presents or carving a turkey. To keep your family from feeling blindsided and to make the most of your conversation, consider these tips. Read more…

Transition to Adulthood: What Happens Legally When My Child Turns 18?

This week we explore what happens legally when your child turns 18, what it means for your ability to make legal, financial and healthcare decisions on their behalf, and what tools you’ll need for a smooth transition to adulthood. Read more…